Ascending Price Trend Lines in Forex Trading

Let’s get Started

Traders often rely on ascending price trend lines in the world of forex trading to confirm strong Bullish Pressure in the current market and make informed trading decisions.

In this guide, we will explore the concept of these rising market price trend lines, their characteristics, drawing techniques, and their significance in forex trading.

By grasping the principles and techniques associated with ascending price trend lines, traders can enhance their analytical skills and potentially capitalise on profitable opportunities in the market.

Understanding Ascending Price Trend Lines

Ascending price trend lines are graphical representations of the upward movement of prices over time.

They provide traders with a visual tool to identify and confirm an uptrend in the market.

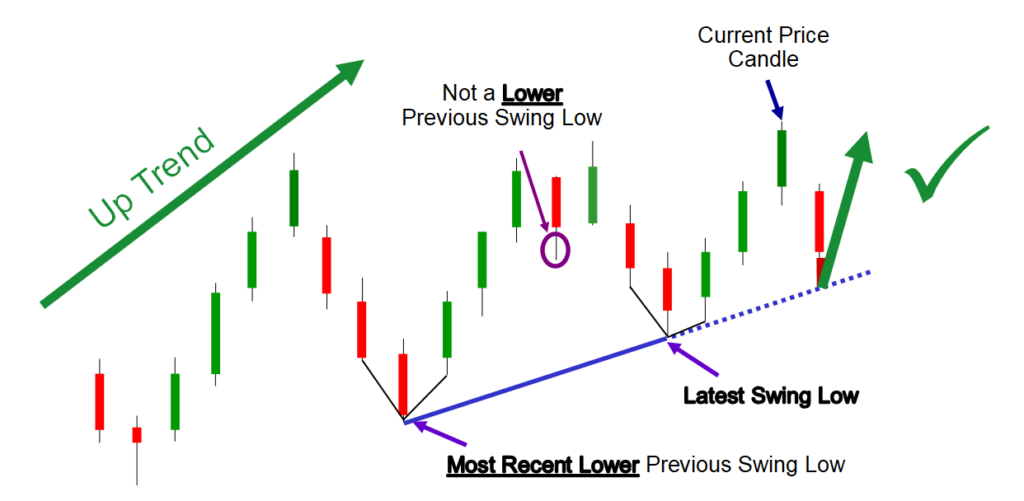

These rising market price trend lines are formed by connecting a series of higher swing lows, creating a diagonal line that acts as a price support level.

These trend lines demonstrate the overall bullish sentiment, where buyers dominate and push prices higher.

Drawing Ascending Price Trend Lines

To draw a rising market price trend line, traders must identify at least two progressively higher swing lows.

The first step is to connect the lowest swing low with the subsequent higher swing low using a straight line. This line should not intersect with any price action between the swing lows.

Once the trend line is drawn, it acts as a support level, guiding traders in assessing the potential direction and strength of the upward trend.

Characteristics of Ascending Price Trend Lines

Rising market price trend lines possess several key characteristics that traders should be aware of:

Upward Sloping

These price trend lines will always slope upwards, reflecting the bullish nature of the market.

The positive slope indicates consistent buying pressure and upward momentum.

Support Level

The trend line acts as a support level, indicating the price level at which buyers are willing to enter the market.

It provides a reference point for traders to assess potential buying opportunities.

Higher Swing Lows

Each swing low connected by the trend line is higher than the previous swing low, indicating the upward momentum in the market.

This sequence of higher lows reinforces the bullish bias and showcases the strength of buyers.

Validation

The more times the price touches or bounces off the trend line without breaking it, the more valid the trend line becomes.

Multiple touches or bounces enhance the significance of the trend line as a support level.

Significance of Ascending Price Trend Lines

Bullish price trend lines hold significant importance in forex trading.

Here are a few key reasons why they are valuable:

Trend Identification

Long Market price trend lines help traders identify and confirm the presence of an upward trend in the market.

This knowledge enables traders to align their trades with the prevailing market direction, increasing the likelihood of successful trades.

Entry Points

Long Market price trend lines provide traders with potential entry points during pullbacks or when the price touches the trend line.

Buying near the trend line can offer advantageous risk-to-reward opportunities, as it allows traders to enter the market at a relatively lower price in the context of the uptrend.

Stop Loss Placement

Placing a stop loss below the support price trend line helps traders manage risk by protecting against potential losses in the event of a trend reversal.

The trend line acts as a logical level for placing stop losses, as a break below the trend line may indicate a significant shift in the market sentiment.

Profit Targets

Traders can set profit targets by projecting the width of the trend line upwards.

This projection provides potential price levels for traders to consider closing their positions and securing profits.

It serves as a reference for assessing the potential upside of the price movement.

Trend Reversal Signals

A break below the support price trend line may indicate a potential trend reversal.

Traders should reassess their positions or consider opening short positions when such a break occurs.

This break may suggest a shift in market sentiment and the emergence of bearish pressure.

Factors to Consider when Using Ascending Price Trend Lines

While these bullish market trend lines are valuable tools, traders should consider the following factors for effective utilisation:

Timeframe Selection

Different timeframes may exhibit varying accuracy and reliability when drawing and utilising ascending price trend lines.

Traders should choose a timeframe that aligns with their trading goals and preferences.

Shorter timeframes may offer more frequent but potentially less reliable signals.

In comparison, longer timeframes provide a broader perspective with fewer signals.

Supportive Analysis

Combining ascending price trend lines with other technical indicators or chart patterns can strengthen trading decisions.

Supportive analysis from multiple indicators can enhance the validity of the analysis and provide additional confirmation before making trading decisions.

False Breakouts

Traders should be aware of false breakouts, where the price briefly breaks below the trend line but quickly resumes its upward movement.

False breakouts can lead to premature exits or false signals.

Proper risk management, including stop losses and confirmation from other indicators, can help mitigate the impact of false breakouts.

The Final Word

Bullish price trend lines are valuable tools in a forex trader’s toolkit.

By understanding the concept, drawing techniques, and characteristics of ascending price trend lines, traders can gain insights into the market’s upward trends and potentially identify profitable opportunities.

These trend lines assist in trend identification, entry point determination, and risk management.

Considering factors such as timeframe selection and supportive analysis is crucial when utilising ascending price trend lines.

With practice, observation, and continuous learning, traders can effectively incorporate ascending price trend lines into their trading strategies and increase their chances of success in the forex market.

To look at these concepts in action, please visit our sister site, Latest Forex Rates

For more trading term general definitions, visit our A to Z of Forex Trading

What to do Next

If you have more questions or need further guidance, don’t hesitate to reach out to us at The Trading Coach International for personalized coaching and support.

If you would like to learn more about trading forex profitably and what steps you can take next to get on the right track to build your Lifestyle Income From Trading, you can book an no obligation, Free Strategy Call with our Lead Trading Coach by clicking on THIS LINK

Disclaimer

The information, strategies, techniques and approaches discussed in this article are for general information purposes only and studies of potential options. The Trading Coach International does not necessarily use, promote nor recommend any strategies discussed in this article. The information in this article may not be suitable for your personal financial circumstances and you should seek independent qualified financial advice before implementing any financial strategy. The Trading Coach International is not a financial advisor and does not have AFS registration.