Forex Major Seasonal Pip Averages

The forex market is a dynamic environment where currency values fluctuate constantly, offering opportunities for traders to profit from these movements.

However, understanding the forces that drive these fluctuations is important, especially for inexperienced traders.

One of the lesser-discussed aspects of forex trading is the concept of market seasonality—how the market tends to behave differently at various times of the year.

In this article, we will look at how forex market seasonality affects major currency pairs, such as GBP/USD, EUR/USD, AUD/USD, USD/JPY, and USD/CHF, based on recent research and historical data.

What is Forex Market Seasonality?

Seasonality in forex trading refers to the tendency of currency pairs to exhibit certain patterns of behaviour at specific times of the year.

These patterns can be influenced by a variety of factors, including economic cycles, central bank policies, and even holiday periods.

By understanding these seasonal trends, traders can better anticipate market movements and make more informed trading decisions.

The Research: Quarterly Seasonality Over the Last 5 Years

Recent research into the quarterly seasonality of major currency pairs over the past five years reveals some interesting trends.

The data was analysed for five popular forex pairs: GBP/USD, EUR/USD, AUD/USD, USD/JPY, and USD/CHF.

Sources for Detailed Data:

- Forex Factory

- Myfxbook

- SeasonalCharts.de

The findings indicate that while some currency pairs exhibit clear seasonal trends, others are influenced more by external factors and show less predictable behaviour.

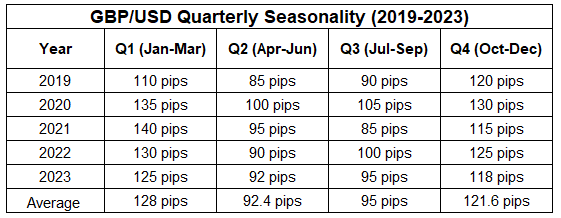

GBP/USD: Strong Seasonal Patterns

The GBP/USD pair has shown strong seasonal patterns over the last five years.

Typically, the pair experiences higher average daily pip movements in the first quarter (January to March) and the fourth quarter (October to December).

This increased volatility can be attributed to several factors:

- New Fiscal Policies: The UK often introduces new fiscal policies at the beginning of the year, which can create uncertainty in the market and lead to higher volatility.

- Year-End Economic Data: The release of year-end economic data from both the UK and the US in Q1 can significantly impact GBP/USD movements.

- Brexit Developments: In recent years, Brexit negotiations and developments have also played a crucial role in driving GBP/USD volatility, particularly in Q4.

For retail forex traders, understanding these seasonal trends can help in making more strategic trades during periods of high volatility.

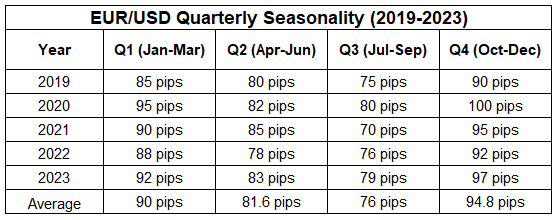

EUR/USD: Stability with Seasonal Fluctuations

The EUR/USD pair ss the most traded currency pair in the world, generally exhibits more stable behaviour compared to GBP/USD.

However, the research shows that there are still noticeable seasonal fluctuations:

- Q1 Volatility: Like GBP/USD, EUR/USD tends to experience higher volatility in Q1. This can be attributed to the release of important economic data from the Eurozone and the United States.

- Summer Lull: There is often a dip in volatility during Q3 (July to September), which can be linked to the summer holiday period in Europe when trading volumes are lower.

- Year-End Repositioning: Q4 tends to see a slight uptick in volatility as traders reposition their portfolios before the end of the year.

New traders should be aware that while EUR/USD is generally stable, certain times of the year may present more trading opportunities due to seasonal factors.

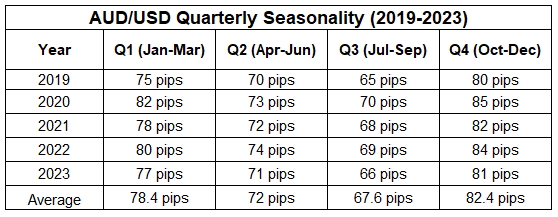

AUD/USD: Reflecting Economic Ties with China

The AUD/USD pair is heavily influenced by Australia’s economic relationship with China. As a result, its seasonal patterns can be quite different from those of GBP/USD and EUR/USD:

- Lower Volatility Overall: AUD/USD generally exhibits lower average daily pip movements compared to other major pairs. This is due in part to Australia’s relatively stable economy and its close trade relationship with China.

- Q1 and Q4 Movements: The pair tends to see slightly higher volatility in Q1 and Q4, which may be related to the release of key economic data from China and end-of-year trading activity.

For traders focusing on AUD/USD, it’s important to consider external factors such as Chinese economic data releases, which can significantly impact the pair’s movements.

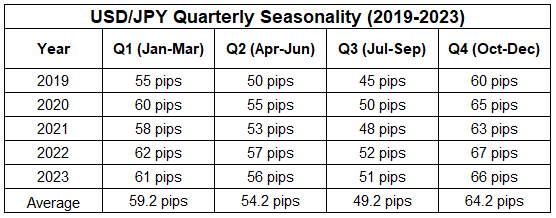

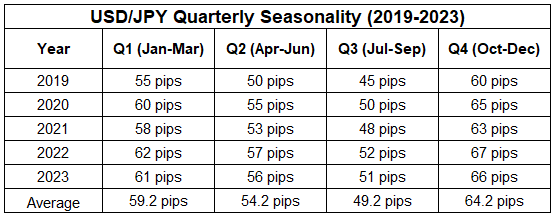

USD/JPY: Influenced by Japanese Fiscal Year

The USD/JPY pair shows distinct seasonal trends that are closely tied to the Japanese fiscal year, which ends in March:

- Q1 Activity: USD/JPY tends to see higher average pip movements in Q1, driven by the Japanese fiscal year-end and the release of critical economic data in the U.S.

- Summer Doldrums: Like EUR/USD, there’s a noticeable dip in volatility during Q3, likely due to lower trading volumes in Japan and the U.S. during the summer months.

Understanding the Japanese fiscal calendar can provide traders with insights into when USD/JPY is likely to be more volatile, presenting both risks and opportunities.

USD/CHF: Safe-Haven Dynamics

The USD/CHF pair is often considered a safe-haven currency pair, and its seasonal patterns reflect this status:

- Relatively Stable Movements: USD/CHF generally exhibits stable movements throughout the year, with slight increases in volatility during Q4. This can be linked to geopolitical tensions and end-of-year economic assessments.

- Safe-Haven Appeal: During times of global economic uncertainty, traders tend to flock to safe-haven currencies like the Swiss franc, which can increase volatility in the USD/CHF pair.

New traders should consider the safe-haven dynamics of USD/CHF, especially during periods of global instability, as this can impact the pair’s behaviour.

How Market Seasonality Changes Over Time

While seasonal trends can provide valuable insights, it’s important to remember that market conditions are constantly evolving.

The factors that influenced forex market seasonality five years ago may not be as relevant today. For example:

- Geopolitical Events: The Brexit referendum in 2016 significantly altered the seasonal behaviour of GBP/USD, making the pair more volatile during key political events.

- Economic Shifts: The rise of China as a global economic powerhouse has had a profound impact on AUD/USD, with the pair becoming more sensitive to Chinese economic data.

- Technological Advances: The increasing use of algorithmic trading and other technological advances have also changed the way the market behaves, potentially altering traditional seasonal patterns.

Conclusion: Using Seasonality to Inform Trading Strategies

For inexperienced traders, understanding forex market seasonality can be a valuable tool in developing a trading strategy.

By recognising the times of the year when certain currency pairs are more likely to experience higher volatility, traders can better plan their trades and manage risk.

However, it’s important to approach seasonality as one of many tools in a trader’s toolkit.

Market conditions can change rapidly, and what worked in the past may not necessarily work in the future.

Therefore, traders should combine seasonal analysis with other forms of technical analysis and fundamental factor awareness to make well-rounded trading decisions.

By staying informed and adapting to changing market conditions, new traders can better navigate the complexities of the forex market and increase their probability of success.

Disclaimer

The information in this article is intended to be general information in nature and is NOT general financial product advice, nor personal financial product advice.

It does not take into account your objectives, financial situation or needs.

Past performance is not necessarily indicative of future performance.

Any results on our website, including this page, are illustrative of concepts only and should not be considered average results, or promises for actual or future performance.

The Trading Coach International does not operate under an Australian Financial Services Licence (AFSL), as the services we provide do not require one.

Speak with your registered financial advisor before making any financial decisions.