The Challenges of Home Ownership in Australia for Dual-Income Couples

Homeownership has long been a cornerstone of the Australian dream, symbolising stability, success, and a sense of belonging.

However, in recent years, the path to purchasing a home has become increasingly difficult, particularly for those who do not already own property.

This challenge persists even when both members of a couple are working full-time.

The rising property prices, stagnant wage growth, and the growing cost of living have all contributed to a housing market that feels out of reach for many Australians.

The Average Mortgage Cost in Australia

The average mortgage cost in Australia is a critical factor for couples considering homeownership.

As property prices continue to rise, so too do the costs associated with financing a home.

According to recent data, the average mortgage size in Australia has surpassed $600,000, with this figure varying significantly based on location.

In Sydney, for example, where property prices are among the highest in the country, the average mortgage can easily exceed $800,000.

The financial commitment of servicing such a large mortgage is substantial.

With a typical loan term of 25 to 30 years, the monthly repayments can place a significant strain on household budgets, particularly for those who are also managing other expenses such as childcare, education, and day-to-day living costs.

For many dual-income couples, the dream of owning a home comes with the reality of long-term financial obligations that can impact their lifestyle and future financial security.Rising Property Prices

One of the most significant barriers to homeownership in Australia is the skyrocketing property prices.

Over the past decade, the average cost of a home in major cities like Sydney and Melbourne has surged dramatically.

Even in regional areas, which were once considered more affordable, prices have increased significantly.

For many first-time buyers, saving for a deposit has become a daunting task.

The traditional 20% deposit required by most lenders can easily amount to hundreds of thousands of dollars in cities like Sydney, where the median house price hovers around the million-dollar mark.

Even with both partners in a couple working full-time, the time it takes to save for a deposit has extended far beyond what it was for previous generations.

Stagnant Wage Growth

While property prices have soared, wage growth in Australia has remained relatively stagnant.

The gap between income and the cost of housing has widened, making it increasingly difficult for dual-income households to keep up.

In the past, a single income was often enough to purchase a home, but today, even with two full-time incomes, many couples find themselves struggling to save enough for a deposit, let alone afford the monthly mortgage repayments.

The situation is exacerbated by the fact that wages have not kept pace with inflation, leading to a decline in real purchasing power.

This stagnation in wage growth has also meant that many couples are forced to make significant sacrifices in other areas of their lives, such as delaying starting a family, cutting back on leisure activities, or forgoing holidays, just to save enough for a deposit.

The Rising Cost of Living

The cost of living in Australia has also been steadily increasing, placing additional pressure on dual-income couples trying to save for a home.

Expenses such as childcare, education, healthcare, and transportation have all risen, eating into the disposable income that could otherwise be saved for a house deposit.

In addition, the cost of renting has also increased, particularly in major cities.

This creates a vicious cycle where couples are spending more on rent, leaving less money available to save for a deposit.

The high cost of living, combined with rising rents, makes it incredibly difficult for many couples to break into the property market.

Impact of Interest Rates

Interest rates play a crucial role in determining the affordability of home loans.

Over the past decade, Australia has experienced a period of historically low interest rates, which has contributed to the increase in property prices.

While low-interest rates can make borrowing more affordable, they also tend to inflate property prices, as buyers are willing to take on larger loans.

However, the recent trend of increasing interest rates adds another layer of difficulty for prospective homeowners.

Higher interest rates mean higher mortgage repayments, which can stretch even the most carefully planned budgets.

For dual-income couples, the rising cost of servicing a mortgage may mean that buying a home becomes even less attainable.

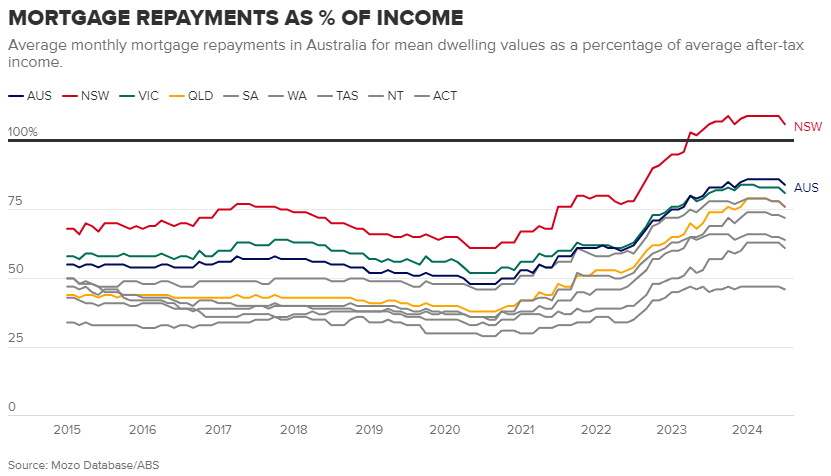

The national average dwelling price of $959,300 requires monthly mortgage repayments of about $5300, or 84 per cent of monthly post-tax earnings.

Victoria only lags behind NSW for unaffordability, with 81 per cent of post-tax income required to service the average home loan, followed by the ACT and Queensland (both 76 per cent), South Australia (72 per cent), Tasmania (64 per cent) and Western Australia (61 per cent).

The Northern Territory (46 per cent) is the only state or territory in the country where the measure falls under 50 per cent.

Government Initiatives and Incentives

The Australian government has introduced several initiatives aimed at helping first-home buyers enter the property market, such as the First Home Owner Grant (FHOG) and the First Home Loan Deposit Scheme (FHLDS).

These programs are designed to reduce the financial burden of buying a home, either by providing a grant towards the purchase price or by allowing buyers to secure a loan with a smaller deposit.

While these initiatives have helped some first-time buyers, they are often criticised for not being sufficient to address the broader issue of housing affordability.

The caps on property prices and income thresholds for eligibility mean that many couples, especially in higher-cost areas, may not qualify for these schemes.

Moreover, these programs can inadvertently contribute to higher property prices by increasing demand without addressing the underlying supply issues.

People that have had to sell their homes due to increasing mortgage costs or because of a marriage breakdown, lose the opportunity to reapply for the FHOG because they had previously owned a home, condemning them to live on the rental roundabout.

The Loss of Affordable Government Built Housing

In the mid-20th century, from the 1950s through to the 1990s, the Australian government played a pivotal role in promoting home ownership by constructing low-cost houses and selling them at affordable prices.

This policy was aimed at making home ownership accessible to a broader segment of the population, contributing significantly to housing availability during those decades.

However, with the cessation of these government-led initiatives, the supply of affordable homes has dwindled, leaving new home buyers struggling to enter the property market.

The lack of similar programs today has exacerbated housing shortages and increased the financial barriers for first-time buyers, making home ownership a more distant dream for many Australians.

Supply and Demand Imbalance

Another factor contributing to the difficulty of homeownership is the imbalance between supply and demand. Australia’s population has been growing steadily, driven by both natural population growth and immigration.

However, the construction of new homes has not kept pace with this growth, particularly in areas of high demand.

This supply shortage has driven up property prices, making it even harder for first-time buyers to enter the market.

The limited availability of land in desirable locations, coupled with zoning regulations and the rising cost of construction, has further exacerbated the problem.

For dual-income couples, this means that even if they can save enough for a deposit, they may find themselves competing with a large pool of buyers for a limited number of properties, pushing prices even higher.

The Emotional Toll

The difficulty of purchasing a home in Australia is not just a financial burden but also takes an emotional toll on many couples.

The dream of owning a home can feel increasingly distant, leading to feelings of frustration, anxiety, and hopelessness.

The pressure to save a large deposit while managing day-to-day living expenses can strain relationships and create a sense of constant stress.

Moreover, the competitive nature of the housing market, where buyers are often forced to make quick decisions or face losing out on a property, can add to the emotional strain.

For many, the process of buying a home becomes a source of significant stress, rather than the fulfilling experience it is often portrayed to be.

The Increase in the Cost of Living

Australia has seen a steady increase in the cost of living over the past decade, which has further complicated the pursuit of homeownership.

Essentials such as groceries, utilities, transportation, and healthcare have all risen in price, putting additional pressure on household budgets.

For dual-income couples, this means that a larger portion of their combined income is being spent on everyday expenses, leaving less available for savings and mortgage repayments.

The rising cost of living is particularly acute in major cities, where the concentration of jobs and amenities often comes with a higher price tag for goods and services.

Even in regional areas, where living costs were traditionally lower, there has been a noticeable uptick in prices, partly driven by the influx of people seeking more affordable housing options outside of the capital cities.

This financial squeeze leaves many couples with difficult choices, such as delaying major life decisions, cutting back on discretionary spending, or accepting a longer commute in exchange for more affordable housing.

The cumulative effect of these increased costs makes the goal of homeownership even more challenging to achieve.

The Potential for AI and Automation to Replace Many Workers’ Jobs

As Australia faces economic challenges related to housing affordability and the cost of living, another looming concern is the potential impact of AI and automation on the job market.

The rapid advancement of technology has already begun to transform industries, and many experts predict that a significant number of jobs could be automated in the coming years.

For dual-income couples, this creates an additional layer of uncertainty.

The prospect of job displacement due to automation means that even those who are currently employed full-time may face challenges in maintaining their income levels in the future.

Industries such as manufacturing, retail, and even some areas of finance are particularly vulnerable to automation, which could lead to job losses or a shift towards lower-paying, less secure employment.

The potential for widespread job displacement could have serious implications for homeownership, as stable, well-paying jobs are a key factor in securing a mortgage and maintaining the ability to make repayments.

If one or both members of a couple were to lose their job or see a significant reduction in income due to automation, it could jeopardise their ability to purchase a home or keep up with mortgage payments.

Moreover, the uncertainty surrounding the future of work may cause some couples to hesitate in making long-term financial commitments, such as buying a home.

The fear of potential job loss or income reduction could lead to a more cautious approach to borrowing, further dampening demand in the housing market.

In conclusion, while dual-income couples in Australia are already facing significant challenges in the pursuit of homeownership, the potential impact of AI and automation on the job market adds yet another layer of complexity.

As technology continues to evolve, it will be crucial for individuals, employers, and policymakers to address these challenges in order to ensure that homeownership remains an achievable goal for future generations.

Generating Additional Income for Homebuyers

For couples aspiring to buy their own home, generating additional income can be a game-changer in achieving their financial goals.

In today’s dynamic economy, there are several ways to boost income streams, which can be particularly helpful in saving for a deposit or managing mortgage repayments.

- Side Hustles: One of the most popular ways to generate extra income is through a side hustle. Whether it’s freelancing in a field of expertise, offering services like tutoring or consulting, or selling handmade products online, side hustles can provide a significant financial boost. The gig economy offers flexibility, allowing individuals to work around their full-time jobs.

- Renting Out Assets: For those who have assets like a spare room, a car, or even tools and equipment, renting them out can generate additional income. Platforms like Airbnb for short-term rentals or car-sharing services can help couples monetise these assets without requiring a large time commitment.

- Investing Wisely: Another approach to increasing income is through smart investments. While this carries some risk, careful investment in shares, bonds, or even peer-to-peer lending platforms can yield returns that contribute towards a home deposit. It’s essential to approach this strategy with a solid understanding of the market or seek advice from a financial advisor.

- Taking on Overtime or a Second Job: For some, the straightforward approach of working extra hours or taking on a second part-time job can be the most effective way to generate additional income. While this might require significant time and effort, the rewards can be substantial, particularly when saving for a short-term goal like a home deposit.

- Monetising Skills Online: The digital economy has opened up numerous opportunities to monetise skills online. From starting a YouTube channel, blogging, or creating online courses to becoming a virtual assistant or offering digital marketing services, the possibilities are vast. These ventures can start small and grow over time, providing a steady income stream.

- Developing a Trading Income: Leveraging your after-hours free time into a supplementary income is fast becoming a viable option for those who want the freedom of being able to generate a few hundred extra dollars a week to take the pressure off paying their mortgage or household expenses. The added benefit is that trading income is not seen as an extra job, so therefore you will only pay tax on income with your other investment income at the end of the year (check with your accountant)

Realistically Saving Money on Expenses

In addition to generating more income, saving money on everyday expenses is crucial for couples working towards homeownership.

By adopting smart saving strategies, it’s possible to stretch each dollar further and accumulate savings more quickly.

- Creating and Sticking to a Budget: It may not sound exciting, but the foundation of effective saving is a well-planned budget. Couples should track their income and expenses, identifying areas where they can cut back. Sticking to this budget requires discipline, but it’s one of the most effective ways to save money. Prioritising needs over wants and setting clear financial goals can help maintain focus.

- Reducing Unnecessary Subscriptions: Do you really need that tv subscription with so much free content available? With the prevalence of subscription services, it’s easy to accumulate costs for services that are rarely used. Reviewing and cancelling unnecessary subscriptions, whether it’s streaming services, magazine subscriptions, or unused gym memberships, can free up money that can be redirected towards savings.

- Cutting Down on Dining Out: Eating out is often one of the largest discretionary expenses for couples. By cooking at home more often, meal prepping, and bringing lunch to work, significant savings can be achieved. This doesn’t mean eliminating dining out altogether, but rather treating it as an occasional indulgence rather than a regular occurrence. Moderation is the key.

- Shopping Smart: Savvy shopping can also lead to substantial savings. This includes buying in bulk for items that are regularly used, waiting for sales, using discount codes or cashback services, and opting for generic or store brands instead of name brands. Even small savings on groceries and household items can add up over time. Shop around to save big.

- Downsizing or Relocating: If renting, couples might consider downsizing to a smaller apartment or relocating to a less expensive area to save on rent. The money saved can be put directly towards a home deposit. While this might involve some lifestyle adjustments, the long-term benefit of homeownership could outweigh the temporary inconvenience. The Australian Dream can be achievable if you’re flexible about the location.

- Automating Savings: Setting up an automatic transfer to a savings account each time a pay is received ensures that a portion of income is saved before it can be spent. This “pay yourself first” approach makes saving consistent and less tempting to skip, helping to accumulate a home deposit more efficiently. After a while you won’t even notice the difference.

- Reviewing and Refinancing Debts: High-interest debts can be a significant drain on finances. Reviewing existing debts and considering options like debt consolidation or refinancing at a lower interest rate can reduce monthly payments, freeing up more money for savings. Use online comparison sites to look for a better deal. Choosing a new bank and setting up a savings plan can show your new lender how they can expand their services with you to include your mortgage.

By combining strategies to generate additional income with disciplined saving practices, couples can make meaningful progress towards their goal of homeownership.

While it requires effort, creativity, and a commitment to financial planning, the reward of owning a home can make these sacrifices worthwhile.

Rethinking Homeownership: Exploring New Possibilities

As the dream of owning a home becomes increasingly challenging for many Australians, it may be necessary to rethink traditional concepts of homeownership.

This could involve exploring alternative paths to buying a home, such as considering different types of properties, shared ownership, or even looking beyond the city for more affordable options.

- Considering Different Types of Properties: Traditional stand-alone houses in city suburbs are often the most expensive option. Couples might consider looking at townhouses, units, or apartments, which can be more affordable. Another option could be purchasing a fixer-upper— a property in need of renovation. While this requires additional work and investment, it can be a more affordable way to enter the market.

- Exploring Shared Ownership or Co-ownership: Another way to make homeownership more accessible is by considering shared ownership or co-ownership. This involves purchasing a property with family or friends, sharing the costs and the mortgage. While this approach requires careful planning and clear agreements, it can make owning a home more attainable. In the past, this is a strategy that has helped new Australian residents get on the property ladder.

- Investing in Property Before Buying a Home to Live In: Some couples may also consider the strategy of buying an investment property first, rather than a home to live in. By renting out the property and using the rental income to cover the mortgage, couples can build equity in the property market. Later, they may sell the investment property to help fund the purchase of a home to live in.

The Tree Change: Moving to More Affordable Areas

For those struggling to afford a home in the city, a “tree change” might be an option worth considering.

A tree change involves relocating from an urban area to a rural or regional area, where property prices are often significantly lower.

This can make homeownership far more achievable, with the added benefits of a slower pace of life, more space, and a stronger sense of community.

- Choosing Careers and Employment That Can Be Done Remotely: The rise of remote work has opened up new possibilities for where people can live and work. For those considering a tree change, it’s important to choose a career, employment, or business that can be done remotely. Professions in fields like IT, marketing, consultancy, education, and even some types of trade work can often be performed from anywhere with a reliable internet connection.

- Starting a Remote Business: For those with an entrepreneurial spirit, starting a remote business can provide both the flexibility to live in a regional area and the potential for significant income. Online businesses, such as e-commerce, digital marketing agencies, or virtual assistance services, can be run from almost anywhere. This approach not only makes homeownership more attainable but also allows for a lifestyle that is less tied to the hustle and bustle of city life.

- Balancing Lifestyle and Career Aspirations: A tree change isn’t just about finding cheaper property; it’s also about balancing lifestyle and career aspirations. For many, moving to a regional area offers the chance to escape the high-pressure environment of the city and enjoy a more relaxed lifestyle. However, it’s important to consider the availability of employment opportunities, access to services, and the overall lifestyle in the chosen area.

- Understanding the Trade-offs: While property prices may be lower in rural or regional areas, there are trade-offs to consider. These can include longer travel times to visit family and friends, limited access to certain amenities, or fewer career advancement opportunities. It’s crucial to weigh these factors against the benefits of more affordable homeownership and the potential for a better work-life balance.

- Assessing the Future Growth Potential of Regional Areas: When considering a tree change, it’s also important to assess the future growth potential of the area. Some regional areas are experiencing growth as more people move away from cities, leading to increased property values over time. Choosing a location with strong growth potential can not only make homeownership more affordable in the short term but also serve as a good investment for the future.

Consider that, while traditional paths to homeownership may be out of reach for many, rethinking what homeownership looks like and considering alternative options can open up new possibilities.

Whether it’s choosing a different type of property, exploring shared ownership, or making a tree change to a more affordable area, there are ways to make the dream of owning a home a reality.

By embracing flexibility in career choices and being open to new ideas, couples can find innovative solutions to the challenges of today’s housing market.

How to Live in the Property you Want in The Future.

In today’s Australia, the path to homeownership is fraught with challenges, even for dual-income couples.

The combination of rising property prices, stagnant wage growth, the increasing cost of living, and supply and demand imbalances has created a housing market that feels out of reach for many.

While government initiatives have provided some relief, they are often not enough to address the broader issues at play.

For those who do not already own a home, the dream of homeownership can feel like an elusive goal, requiring significant financial sacrifices and emotional resilience.

As Australia continues to grapple with these challenges, it remains to be seen what measures can be taken to make homeownership more accessible for all.

Disclaimer

The information in this article is intended to be general information in nature and is NOT general financial product advice, nor personal financial product advice.

It does not take into account your objectives, financial situation or needs.

Past performance is not necessarily indicative of future performance.

Any results on our website, including this page, are illustrative of concepts only and should not be considered average results, or promises for actual or future performance.

The Trading Coach International does not operate under an Australian Financial Services Licence (AFSL), as the services we provide do not require one.

Speak with your registered financial advisor before making any financial decisions.