The Resilient Pip Movement in Forex: A Closer Look at Major Currency Pairs

I was recently asked by a LIFTER if the currency pairs are trading in as much volume on a daily basis in the current market in comparison to the historical data.

So, me being me, went down the rabbit hole of research into the average pips in the most recent quarter compared with the last 1, 2 and 5 years…

The outcome is very interesting:

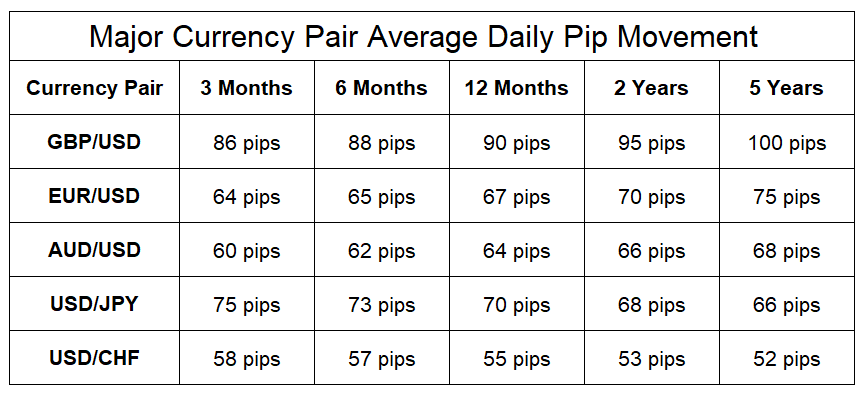

Here’s a summary of the average daily pip movement over different time periods for the selected forex currency pairs:

These figures are indicative of the volatility seen in these currency pairs over the specified periods, reflecting both short-term and long-term trends in the forex market.

The Sources for this data:

- DailyFX

- Forex Education

- Historical market data analyses from various forex trading platforms.

Despite the challenges the forex market has faced in recent years, the average daily pip movements for major currency pairs like GBP/USD, EUR/USD, AUD/USD, USD/JPY, and USD/CHF remain robust.

This resilience may be attributed to a shift in trading volumes, with more activity occurring during the New York trading session compared to the traditionally dominant London morning session.

This article will look at each currency pair’s performance, explore potential reasons behind these movements, and suggest why these trends offer opportunities for forex traders.

GBP/USD: The Pound’s Resilience

The GBP/USD pair has shown an impressive average daily pip movement over the last five years, with the most recent three-month average standing at 86 pips.

Even as the market becomes more challenging, with economic uncertainties stemming from Brexit and the broader global economic slowdown, the GBP/USD remains a highly volatile pair.

Over the last 12 months, the average daily movement has been approximately 90 pips, which is indicative of the pair’s persistent volatility.

The slight increase in volatility in the last 12 months could be due to intensified trading during the New York session, as traders react to U.S. economic data and political events, which often have significant impacts on GBP/USD.

The New York session, which overlaps with the latter part of the London session, has seen increased trading volume, particularly in GBP/USD, as traders position themselves in response to the day’s economic releases.

The shift in volume from London to New York could explain the steady pip movements seen over the past year. For traders, this means that GBP/USD continues to offer significant intraday opportunities, despite broader market challenges.

EUR/USD: The Euro’s Stability Amidst Change

EUR/USD, the most traded currency pair globally, has shown an average daily pip movement of 64 pips over the last three months, with a slightly higher figure of 67 pips over the past year.

Despite lower volatility compared to GBP/USD, the EUR/USD remains a staple for traders due to its liquidity and the sheer volume of trades it attracts.

The relatively stable pip movement can be seen as a reflection of the Eurozone’s economic policies and the U.S. Federal Reserve’s actions.

The steady 75-pip average over the last five years suggests that while there have been fluctuations, the EUR/USD has not deviated significantly from its historical norms.

One notable observation is the increase in pip movement during the New York session, especially in the last 12 months.

This could be attributed to the increasing importance of U.S. economic data releases and the impact of U.S. monetary policy decisions on the Euro.

As more traders align their activities with the New York session, the EUR/USD pair has maintained its daily pip movement, offering consistent trading opportunities for those attuned to economic developments in both Europe and the U.S.

AUD/USD: The Aussie Dollar’s Volatility

The AUD/USD pair has also shown resilience, with an average daily pip movement of 60 pips over the last three months and 64 pips over the last 12 months.

The Australian dollar, often seen as a proxy for global risk sentiment and commodity prices, particularly iron ore and gold, has maintained a steady level of volatility.

The pair’s movement has been influenced by shifts in global trade dynamics, particularly with China, Australia’s largest trading partner.

Noticeably, the New York session has become increasingly significant for AUD/USD, especially with U.S. economic data influencing global commodity prices and risk sentiment.

The 68-pip average over the last five years underscores the pair’s consistent volatility, making it a favourite for traders looking to capitalize on short-term price movements.

The steady pip movement also suggests that despite global economic challenges, AUD/USD continues to offer profitable trading opportunities, especially during times when U.S. markets are in full swing.

USD/JPY: The Yen’s Safe-Haven Status

USD/JPY has traditionally been known for its lower volatility compared to other major pairs, with an average daily pip movement of 75 pips over the last three months and 70 pips over the last year.

However, the pair’s movements have been more pronounced in the last two years, averaging 68 pips, which could be due to the yen’s safe-haven status amidst global economic uncertainty.

The New York session has played a crucial role in USD/JPY’s movements, particularly as traders react to U.S. economic data and Federal Reserve decisions.

The increased activity during this session has kept the pair’s volatility at a steady level, offering traders ample opportunities to profit from intraday movements.

The yen’s role as a safe haven means that during periods of market turmoil, USD/JPY often sees increased volatility as traders flock to the safety of the yen.

This trend has been evident in the pair’s consistent pip movement, providing a reliable option for traders during uncertain times.

USD/CHF: The Swiss Franc’s Steadfastness

The USD/CHF pair, often seen as a gauge of risk sentiment due to the Swiss franc’s safe-haven status, has shown an average daily pip movement of 58 pips over the last three months, with a consistent decrease in volatility over the last five years, now averaging 52 pips.

Despite the lower volatility compared to other major pairs, USD/CHF remains an important pair for traders, particularly during times of economic uncertainty.

The New York session’s influence on USD/CHF has grown, with more trading volume shifting somewhat recently from the London morning session to New York as traders react to U.S. market data.

The pair’s lower volatility reflects the franc’s stability, but the consistent pip movement indicates that there are still trading opportunities, particularly for those looking to trade during the New York session when the pair tends to be more active.

Conclusion: Navigating the Shifting Forex Landscape

The average daily pip movements for major currency pairs such as GBP/USD, EUR/USD, AUD/USD, USD/JPY, and USD/CHF remain strong, even in a challenging market environment.

This resilience could be attributed to the increasing significance of the New York trading session, where more volume is now being traded compared to the traditionally dominant London morning session.

For forex traders, this shift presents both challenges and opportunities.

While the market dynamics are changing, the consistent pip movements across these pairs suggest that there are still plenty of opportunities to capitalize on intraday price movements in the London Morning session.

Those traders who have the opportunity to trade the New York session and stay informed about U.S. economic data releases, traders can better position themselves to take advantage of the opportunities that arise.

In a market that is constantly evolving, adaptability and a keen understanding of market trends are crucial.

The steady pip movements in these major currency pairs offer a silver lining for traders looking to navigate the shifting forex landscape

Economists suggest that there is a stronger potential for the volume to shift back to the London Morning session when the global economy is more stable and there is more balance in the data.

London morning session traders should still find plenty of opportunities for profitable trades even under the current balance.

Disclaimer

The information in this article is intended to be general information in nature and is NOT general financial product advice, nor personal financial product advice.

It does not take into account your objectives, financial situation or needs.

Past performance is not necessarily indicative of future performance.

Any results on our website, including this page, are illustrative of concepts only and should not be considered average results, or promises for actual or future performance.

The Trading Coach International does not operate under an Australian Financial Services Licence (AFSL), as the services we provide do not require one.

Speak with your registered financial advisor before making any financial decisions.