What are the Best Forex Currency Pairs to Trade?

Choosing the best currency pairs to trade is a vital factor to help a trader maximise the potential and profitability of their trading strategy or technique.

Contrary to popular belief among some groups of new traders, the forex currency pairs are not equal or even similar, since they have distinct “personalities” characteristics and factors that affect their value and competitiveness in the Market.

For instance, currency pairs from emerging or developing economies tend to be less liquid and more volatile due to fewer market participants. This means you might find you would have a higher percentage of large negative trades due to unexpected price spikes and and have difficulty exiting an unprofitable trade quickly.

On the other hand, “Major” currencies, including the Great British Pound, the Euro or the US dollar, are highly liquid and less prone to irregular price fluctuations, which makes it easy to trade the currency pair, as the price movements and trends tend to move in more predictable patterns.

Successful forex traders actively develop their trading skills and strategy through consistent practice, discipline, trading risk management and by mastering their high probability trading setup or technique.

Profitable traders will select the best forex currency pairs that match their method and goals and incorporate them in their trading strategy to maximise their potential of profitable trades that will earn consistent profits.

What Do Currency Pairs Look Like?

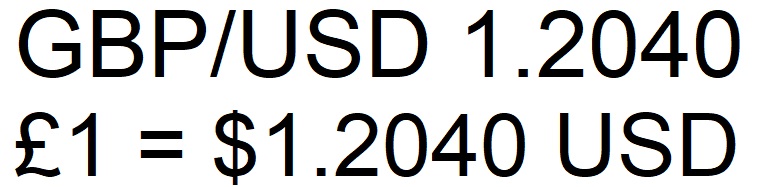

In each Currency Pair, the first currency is called the “Base” and the second is called the “Quote”.

Question mark 3d turquoise punctuation mark asking interrogation sign symbol icon

When reading the value of a Currency Pair, the figure equals how many of the Quote Currency you can purchase for 1 of the Base Currency.

If the GBPUSD value is currently 1.2040, this means you can purchase 120.4 US cents for every 1 Great Pritish Pound.

What are your goals?

When approaching trading the forex trading market, it’s vital to ensure that you recognize and understand the value of proper preparation.

Having clear and well-defined goals is essential to ensure that your trading method and strategy work together seamlessly to achieve your goals as a successful trader.

A trader should focus on setting clear and realistic profit goals for each trade, each month and for the year.

Setting realistic achievable and predictable profit targets will enable you to realise the sort of returns or profits you expect, so that you don’t put unnecessary pressure on yourself at the start of every trade.

Setting realistic profit targets will help reduce tension and stress in your trading and positively impact your results.

Let’s be clear, when we say realistic, we’re not saying small profits… we’re talking about the realistic average profit made on your currency pair in the trade duration that’s consistent with your trading method. If your trading method cannot clearly identify the potential average profit per trade, then you may need to revise your method…

Do the currency pairs’ movements align with your goals?

Traders should see each Currency Pair as its own individual investment product with its own rhythm, cycle and even personality.

Some Currency Pairs are steadier and slower to react to unusual or changed market conditions, while others are more volatile and can swing quickly and further in response to the smallest change in conditions.

In understanding the temperament of the different pairs, you should be better able to find one, two or three pairs that will be your “go to” pairs because they better align with your own temperament, your strategy and personal goals.

When trading the different currency pairs in the market, it’s vital to ensure that you choose a methodology, approach, currency pair and proven profitable system that will align and help you accomplish your trading goals.

For instance, finding a consistent technique by choosing the most appropriate time frame for your trading is significant to achieve success and a trading strategy that aligns with your goals.

As part of your growth as a trader, a worthy goal would be to find a Currency Pair that consistently performs well in a trading time frame that is appropriate to your temperament.

Trading with an intra day focus, where you can lock in consistent short term profis and compound between positions, only being in a trade where you are on the market, able to respond to opportunities and threats and take timely action to lock in profit or minimise loss will help you have certainty about your trades and will help you avoid any overnight exposure.

The Major forex currency pairs to trade

GBP/USD

The British pound and US dollar pair is an efficient pair to trade since it’s sufficiently volatile and highly liquid.The pair is the “tried and true” pair for our LIFT Investor Traders, accounting for at least 65% to 70% of the profitable trades our LIFT Investor Traders take.

This pair is highly influenced by fundamental data and news that significantly impacts the United Kingdom’s economy.

Its price movement cycles suit The LIFT Trading Method, with a focus on intra day trading opportunities with support from Day, Swing and Position Traders giving frequent opportunities to catch larger price runs that boost our profits.

It’s a versatile currency pair, providing just as strong trade opportunities for those traders who are more comfortable trading longer term positions.

For those Traders trading from Australia, the London Morning Trading Session aligns with the late afternoon / early evening local time, giving traders the opportunity to build a part time income, whilst still maintaining their current day job.

The GBP/USD pair and the EUR/USD move similarly, often giving opportunities for those traders who miss a trade on one to find a trade soon after on the other.

The average daily price movement over the last 5 years for the GBPUSD is approximately 111 Pips

EUR/USD

The euro/ US dollar forex currency pair is regarded as one of the most profitable pairs due to its high liquidity and high trading volume.

The US economy has the largest traded currency in the world, while the European Union economy with its combined individual countries’ production recognised as the second largest globally.

These currencies are mostly traded due to the large volume of financial institutions and banks in European countries and the United States.

The high trading volume in this pair leads to increased liquidity, making it easier for a trader to trade the euro and us dollar. It’s a pair that is easy to trade since it’s less prone to irregular price fluctuations. This may mean that the Market doesn’t move as quickly or as far as the GBPUSD.

Because of this, trade entry and exit levels can be closer together, producing consistent, but slightly smaller individual trade profits on average.

Many Retail Traders trade the EURUSD because it is consistent. The EUR/USD pair gives many LIFT Investor Traders approximately 25% of their profitable trades.

The average daily price movement over the last 5 years for the EURUSD is approximately 95 Pips

AUD/USD

The Australian dollar and US dollar pair is, from our experience the remaining major currency pair in the top 3 of the forex trading market.

Also known as the Aussie, the pair trades consistently, especially during the Australian day time, “filling the gap” in the market between the New York Close and the London Open.

If you’re trading in the evening in the US, or trading during the day in the Pacific / Asian time zones, the AUDUSD has the potential to provide strong high probability trading opportunities.

The Australian dollar is typically a commodity currency with a value that is actively tied to the value of the major exports like agricultural products, oil and precious metals.

As such, the price movement is generally more considered, giving consistent, but mostly smaller individual price cycles. There is still plenty of profit to be had in the AUDUSD, but traders may need to be more patient and hold trade entries for the highest probability opportunity.

The average daily price movement over the last 5 years for the AUDUSD is approximately 71 Pips

USD/JPY

The USDJPY is one of the most traded Asian currency pairs.

The Japanese economy is a free market hugely dependent on exports.

The Japanese yen is sometimes called the “safe-haven currency” since investors and traders have historically invested in it to offset risk in times of economic instability and uncertainty.

This currency is highly influenced and impacted by the exchange rate statements and policies of the Bank of Japan.

This means that the USDJPY price has the potential to move against the expected market pressure because the Japanese government actively artificially inflates the value of the currency by holding onto reserves if it thinks the market value is too low, or on the opposite side, it can flood the market with currency to lower the value if they believe that the currency value is too high, which can have a damaging effect on the attractiveness of purchasing Japanese exports by international buyers.

The USDJPY can be one of the most challenging of the majors to trade for newer traders and LIFT Investor Traders generally avoid this pair because of the potential for unexpected price movements.

The average daily price movement over the last 5 years for the USDJPY is approximately 62.5 Pips

What is an “Exotic” Currency?

Exotic currencies are thinly traded in foreign exchange markets and are not extensively traded by most major financial institutions.

Exotic currencies lack market depth, can be highly volatile, have lower liquidity and generally trade at low volumes.

Due to the lack of liquidity, trading or investing, exotic currencies can be expensive since the bid-ask spread is typically huge, meaning that it is harder to make a profit for traders.

Exotic currencies are often synonymous with emerging markets or developing countries and subject to total or partial exchange rate controls that render them nonconvertible.

Examples of exotic currencies include the Iraqi dinar, Thai baht and the Uruguay peso.

Some new Traders are drawn to their exotic nature, hoping to be the one trader in a million who can make money trading exotics, just for their ego or to try to “blaze a trail”. Most of these traders end up losing their hard earned money for no real payoff.

Some of the stronger, more reliable exotics at least have proven economic stability, high levels of exports, proven financial strength and trading value, including the Canadian dollar, the New Zealand dollar and the Swiss franc.

If you’re interested in trading exotics, these 3 are probably your best “bet”.

Cross pairs

A cross-currency pair is a currency pair that does not include the US dollar as either a Base currency or a Quote currency.

This is a currency pair that involves two different currency pairs being weighed against each other in a cross-currency pair without being weighted against the US dollar.

Examples of the standard cross currency pairs traded include the EURGBP, the GBPAUD, GBPJPY and the EURCHF.

The cross-currency pairs allow forex traders to exchange currencies more efficiently and quicker, allowing them to operate better and navigate the forex market fluctuations.

For instance, forex traders could trade or invest in the cross-currency pair of the British Pound and the Euro to make investments based on Brexit.

Without the USD participation, you may find the price movements of cross pairs slower, less responsive during the US Market session and not as predictable.

Conclusion

It’s crucial to select the best forex currency pairs to trade with your Trading Method to increase your probability when executing trades, to earn consistent profits from your trading investment.

Developing the most suitable forex trading strategy and selecting the best forex pairs, including the majors, will provide a solid basis and foundation for trading the forex market and making money in forex.

The LIFT Trading Method has built its strength on the returns generated by focusing on the GBPUSD, EURUSD and AUDUSD currency pairs. Their reliability, volatility and liquidity mean that LIFT Traders can be confident of their trade entries and in the overall planning of their trading business.

For most strong trading methods, focusing on the majors in your strategy will help you obtain better results since the majors are predictable, stable, less prone to irregular price fluctuations, profitable and extensively traded by large volume by banks and financial institutions.

Developing and mastering a strategy using the major currency pair will help you gain profitable trades and make money trading the forex market.

More Information

For more trading term general definitions, visit our A to Z of Forex Trading

To look at these concepts in action, please visit our sister site, Latest Forex Rates

What To Do Next

For more information about LIFT Investor Trader and to get a clear snapshot of the strengths and opportunities ahead of you, book your free strategy call with our Lead Trading Coach using this link: https://calendly.com/thetradingcoach/strategycall

Disclaimer

The information, strategies, techniques and approaches discussed in this article are for general information purposes only and studies of potential options. The Trading Coach International does not necessarily use, promote nor recommend any strategies discussed in this article. The information in this article may not be suitable for your personal financial circumstances and you should seek independent qualified financial advice before implementing any financial strategy. The Trading Coach International is not a financial advisor and does not have AFS registration.