Incorporating Forex Intraday Trading into a Balanced Investment Portfolio

In the dynamic world of investing, forex intraday trading has gained significant traction as a viable method for generating active income for .

This approach involves executing multiple trades within a single day to capitalise on short-term currency fluctuations.

However, integrating this strategy into a balanced investment portfolio requires a thoughtful, disciplined approach, especially when considering risk management, personal circumstances, and aligning trading goals with overall investment objectives.

The Role of Forex Intraday Trading in a Balanced Portfolio

A well-balanced investment portfolio typically consists of a diverse range of asset classes, including stocks, bonds, real estate, and cash.

Each asset class has its own risk-return profile, helping to achieve specific financial goals.

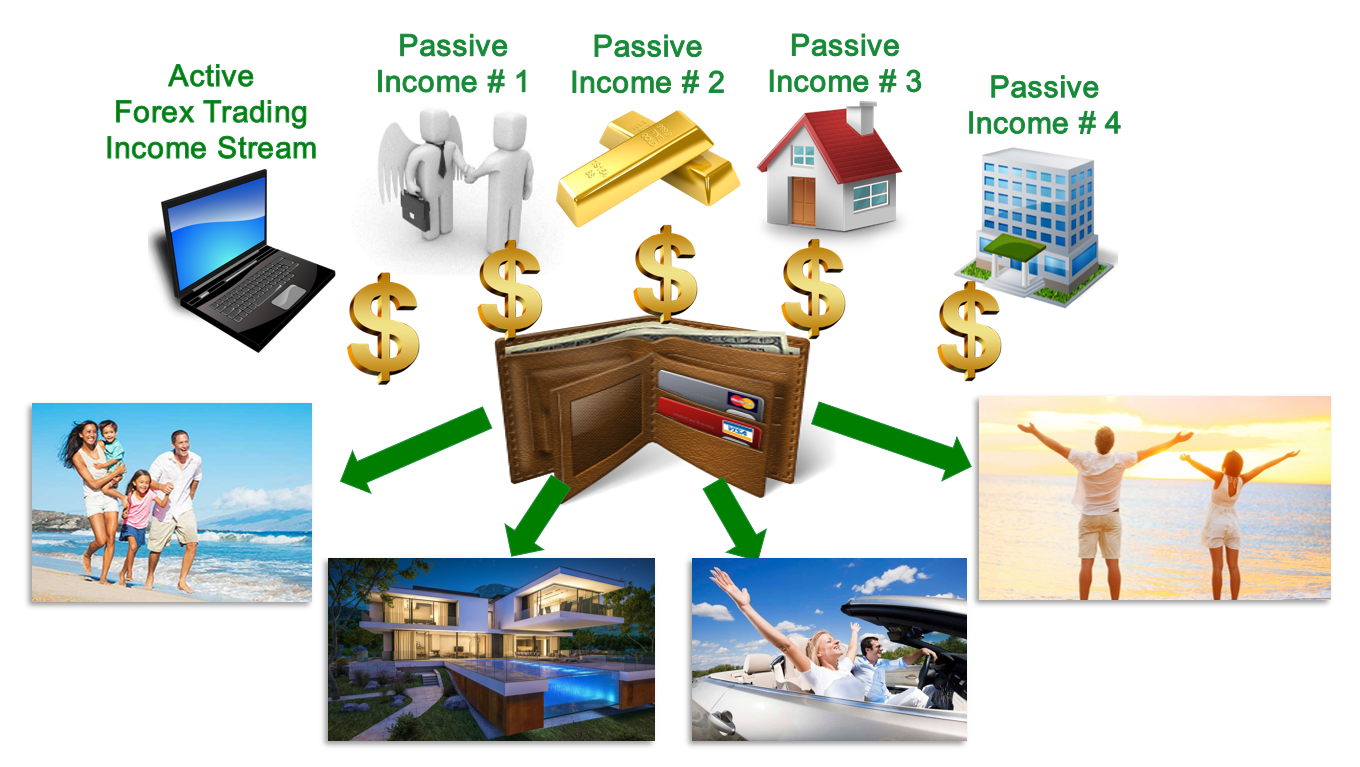

Introducing forex intraday trading into this mix can offer diversification and an additional income stream, especially for investors looking to actively manage a portion of their portfolio.

1. Diversification and Income Generation

Forex intraday trading provides diversification benefits by exposing your portfolio to the global currency market, which operates independently of traditional asset classes like stocks and bonds.

Currency markets are influenced by a different set of factors, such as geopolitical events, economic data releases, and central bank policies.

This global perspective can help reduce exposure to domestic market-specific risks.

Moreover, forex intraday trading allows for potential daily income generation.

Unlike long-term investments that may take years to appreciate, day trading enables you to realise gains on a more immediate basis.

This can be particularly attractive for those seeking to supplement their income or accelerate wealth accumulation.

However, the potential for profit comes hand in hand with risk, necessitating a balanced approach and a strong focus on risk management.

Applying Recognised Risk Management Strategies

Effective risk management is essential for success in forex intraday trading.

Without it, even the most promising strategies can lead to significant losses.

Below are key risk management strategies to consider:

1. Following Proven Trading Strategies

Successful forex trading hinges on following proven strategies that minimise risk and maximise profit.

These strategies often involve technical analysis, such as identifying support and resistance levels, understanding market trends, and using indicators like moving averages and oscillators.

By adhering to these established methods, traders can make informed decisions and reduce the likelihood of costly mistakes.

2. Position Sizing and Capital Allocation

Position sizing refers to the portion of your capital allocated to each trade.

A common guideline is to risk only 1-2% of your trading capital per trade.

This approach protects your overall portfolio from substantial losses if a trade goes against you.

In the context of a balanced portfolio, it’s wise to allocate a modest portion of your total investment capital to forex intraday trading, keeping the majority in more stable, long-term investments.

3. Use of Stop-Losses

A stop-loss is a pre-set price at which you will close your trade if the market moves unfavourably.

This strategy is critical in limiting potential losses and ensuring that your trades are executed within your risk tolerance.

By using stop-losses strategically, you can manage risk effectively while allowing room for your trades to breathe.

4. Avoiding Overtrading

Overtrading is a common pitfall for day traders.

The temptation to capitalise on every market movement can lead to impulsive decisions, increased transaction costs, and heightened risk exposure.

To avoid overtrading, it’s crucial to have a clear trading plan with specific entry and exit criteria based on thorough market analysis.

This disciplined approach helps you focus on high-probability trades rather than reacting to every market fluctuation.

Process Improvement for Advanced Leverage and Margin Opportunities

To fully leverage the benefits of forex intraday trading, it’s important to continually refine your strategies and improve your results.

As your skills and confidence grow, you may become more comfortable using advanced leverage and margin opportunities.

Leverage allows you to control a larger position with a smaller amount of capital, potentially amplifying your profits.

However, it also increases your exposure to risk, making it essential to have a solid foundation of trading experience and a robust risk management plan in place before using leverage.

To get to this level, follow a structured process that includes regular performance reviews, backtesting your strategies, and staying informed about market developments.

By steadily improving your trading approach, you can better position yourself to take advantage of these advanced tools without compromising your overall portfolio stability.

Flexibility in Trading Strategies During Challenging Market Conditions

Markets are inherently unpredictable, and conditions that once favoured your trading strategy can change rapidly.

Flexibility is key to maintaining profitability in forex intraday trading, especially during periods of market volatility or uncertainty.

In challenging market environments, consider adjusting your trading approach.

This might involve reducing your position sizes, tightening your stop-loss orders, or even sitting out of the market entirely if conditions are particularly unfavourable.

Being adaptable in your strategy ensures that you can navigate difficult periods without exposing your portfolio to undue risk.

Aligning Trading Goals with Overall Investment Strategy

Finally, it’s crucial to ensure that your forex intraday trading goals align with your broader investment strategy.

This alignment ensures that your trading activities contribute positively to your overall financial objectives, rather than detracting from them.

For instance, if your primary investment goal is long-term capital growth, you might allocate a smaller portion of your portfolio to forex trading, focusing on strategies that complement your long-term investments.

On the other hand, if generating supplemental income is a priority, you might devote more time and resources to refining your intraday trading techniques.

Setting clear, realistic goals for your forex trading activities—such as daily or monthly profit targets, risk tolerance levels, and time commitments—can help you stay focused and disciplined.

These goals should be revisited regularly to ensure they remain in line with your evolving financial situation and market conditions.

Final Word on Incorporating Forex Trading into a Balanced Investment Portfolio

Incorporating forex intraday trading into a balanced investment portfolio offers the potential for active income generation and enhanced diversification.

However, this approach requires a disciplined, risk-conscious mindset and a thorough understanding of both the opportunities and risks involved.

By following proven trading strategies, managing your risks effectively, and continuously refining your process, you can position yourself to succeed in the fast-paced world of forex trading.

Additionally, being flexible in your approach during challenging market conditions and aligning your trading goals with your overall investment strategy will help you navigate the complexities of the market while staying true to your financial objectives.

Disclaimer

The information in this article is intended to be general information in nature and is NOT general financial product advice, nor personal financial product advice.

It does not take into account your objectives, financial situation or needs.

Past performance is not necessarily indicative of future performance.

Any results on our website, including this page, are illustrative of concepts only and should not be considered average results, or promises for actual or future performance.

The Trading Coach International does not operate under an Australian Financial Services Licence (AFSL), as the services we provide do not require one.

Speak with your registered financial advisor before making any financial decisions.